The Streaming Revolution: 44.8% of TV Viewing in 2025

By Patrick Seaman

CEO @ SportsBug™ | Board Member & Advisor | Futurist | Author

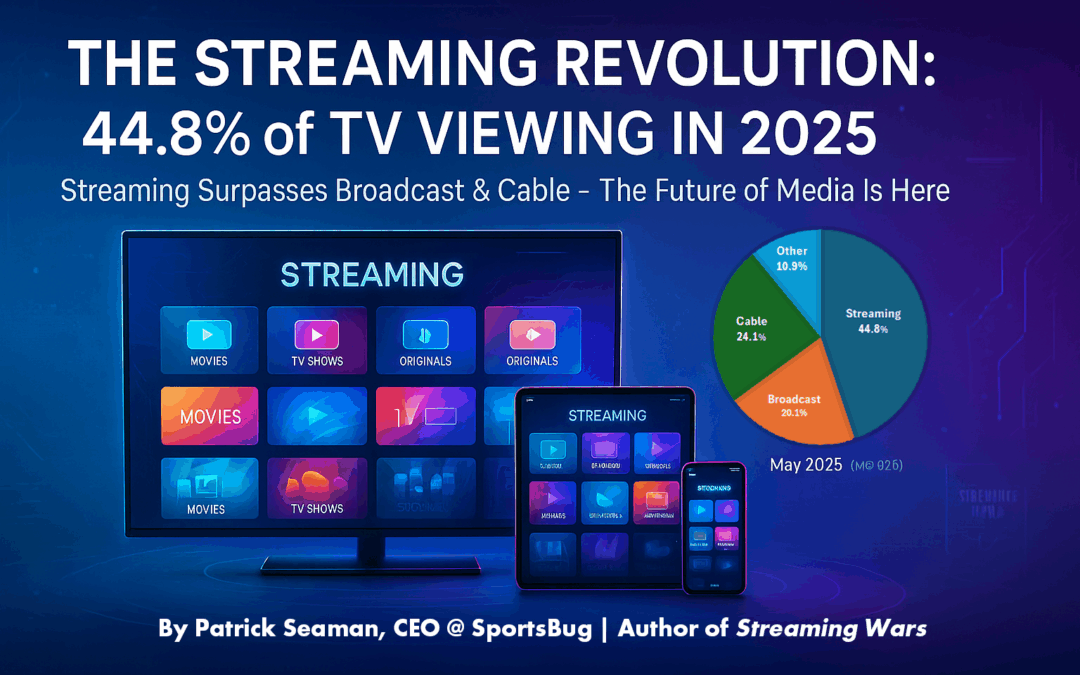

This month, we witnessed a milestone that was both inevitable and shocking: streaming platforms claimed 44.8% of total TV viewing time, finally surpassing the combined viewership of broadcast (20.1%) and cable (24.1%) for the first time ever. This is up from less than 1% in the year 2000.

But here’s what the numbers don’t tell you. It’s not just about market share. It’s about the complete transformation of how we consume, create, and monetize media. We’re witnessing the final act of a revolution that began in cramped server rooms and dial-up connections three decades ago.

The Death of “Appointment Television”

As Nielsen’s research (links listed below) reveals, “streaming weekly minutes are now 71% higher than in May 2021,” representing a seismic shift that’s been building for decades.

This isn’t gradual cord-cutting anymore; it’s a generational handoff of media control.

The numbers tell a story of irreversible change. While broadcast TV has shed viewers month after month, streaming consumption has exploded across every demographic. According to Nielsen’s May 2025 data, this milestone represents the culmination of years of steady growth that accelerated dramatically during and after the pandemic.

Gen Z doesn’t simply prefer streaming; many have never experienced the constraints of linear television. They’ve grown up expecting content on demand, personalized recommendations, and the ability to binge entire seasons in a weekend.

What we’re witnessing echoes the broader transformation outlined in my book Streaming Wars: “Streaming has transformed not just our technology but our culture and expectations, and now we find ourselves at another crossroads.” We’ve moved from the era of networks choosing what we watch to audiences demanding what they want, when they want it.

This shift represents more than convenience. It is a fundamental rebalancing of power. The traditional media gatekeepers who once controlled prime time slots and advertising windows now compete for attention in an algorithm-driven landscape where a Korean drama can become a global phenomenon overnight, and independent creators can build audiences larger than major network shows.

The Economics of Dominance

The financial implications are staggering. Streaming platforms are now commanding advertising premiums that were once exclusive to Super Bowl commercials. Netflix alone generated over $36 billion in revenue in 2024, while traditional networks watch their advertising revenues decline year over year.

Streaming’s dominance comes with new challenges. The subscription fatigue that industry analysts have long predicted is finally materializing. Consumers are becoming more selective, cycling through services based on content availability rather than maintaining permanent subscriptions, forcing platforms to evolve beyond simple content libraries toward comprehensive entertainment ecosystems.

The Next Battlefield: Seamless Monetization

Enter Netflix’s latest gambit, AI-enhanced advertising that represents the industry’s next evolution. Rather than simply inserting commercials between content, Netflix is “using AI to transform ads into immersive content experiences that integrate seamlessly with the show’s visuals.”

This isn’t just clever tech; it’s strategic warfare. Netflix’s ad-supported tier has doubled to 94 million users, and the platform is solving streaming’s biggest puzzle: how to monetize without alienating audiences who fled traditional TV precisely to escape intrusive advertising.

The AI integration goes deeper than surface-level visual blending. Netflix’s system analyzes viewing patterns, emotional engagement markers, and even pause behaviors to optimize ad placement and creative delivery. The technology can adjust ad frequency based on user tolerance levels and modify creative elements to match the tone and pacing of the surrounding content.

This represents a fundamental shift from interruption-based advertising to integration-based marketing. Instead of breaking the viewing experience, these AI-enhanced ads aim to enhance it, creating brand moments that feel like natural extensions of the storytelling rather than commercial intrusions.

The Global Acceleration

The streaming milestone isn’t just an American phenomenon. International markets are experiencing even more dramatic shifts, with some regions seeing streaming adoption rates that dwarf U.S. growth. In markets where traditional cable infrastructure was limited, streaming platforms have become the primary means of accessing premium content.

This global reach has created new content dynamics. Shows like “Squid Game” and “Money Heist” demonstrate how streaming platforms can turn regional productions into worldwide cultural phenomena. The traditional Hollywood-centric model of content creation and distribution has given way to a truly global marketplace where the best stories, regardless of origin, can find massive audiences.

Why This Matters for Business Leaders

The implications extend far beyond entertainment, touching every industry that relies on audience attention and engagement:

For Marketers: The old playbook of buying 30-second spots during primetime is officially obsolete. AI-integrated advertising demands new creative strategies and measurement frameworks. Brands must now think like content creators, developing narratives that can integrate seamlessly with streaming experiences rather than interrupting them.

The shift also requires new metrics. Traditional advertising measured reach and frequency, but streaming demands engagement depth, completion rates, and sentiment analysis. Marketers need to understand not just how many people saw their ad, but how it affected their relationship with the content and platform.

For Tech Leaders: This milestone validates years of infrastructure investment in streaming capabilities, but also signals the need for AI-first content strategies. The technological demands of real-time personalization, content recommendation, and seamless ad integration require sophisticated machine learning capabilities that many organizations are still developing.

Edge computing and 5G networks are becoming critical infrastructure investments as audiences demand higher quality streams with lower latency. The companies that can deliver true real-time experiences will have significant competitive advantages.

For Media Executives: The question isn’t whether to embrace streaming anymore, it’s whether you can innovate fast enough to compete in an AI-enhanced, algorithm-driven landscape. Traditional media companies face the challenge of cannibalizing their own linear revenues while building streaming capabilities that can compete with tech giants.

The content arms race is intensifying, with platforms spending billions annually on original programming. However, success increasingly depends on data-driven content development, global distribution capabilities, and the ability to create cultural moments that transcend traditional demographic boundaries.

For Retail and E-commerce: Streaming platforms are becoming shopping destinations, with technologies like QR codes and interactive overlays enabling instant purchases during content consumption. The line between entertainment and commerce is blurring, creating new opportunities for product placement and direct-to-consumer marketing.

The Algorithmic Power Shift

As Seaman notes in Streaming Wars: “Algorithms designed to control users have found themselves at the mercy of these very same rebels. Now, the balance of power teeters precariously once again.”

This observation captures a crucial tension in today’s streaming landscape. While platforms use sophisticated algorithms to guide viewing choices, audiences have developed their own ways of gaming the system, from coordinated social media campaigns that can make or break new releases to the rise of “ratio-ing” and review bombing that can sink major productions before they find their audience.

The result is a dynamic ecosystem where traditional top-down content distribution meets bottom-up audience curation. Streaming platforms must balance algorithmic efficiency with organic discovery, personalization with serendipity, and content promotion with user autonomy.

The Technology Behind the Transformation

The infrastructure enabling this streaming dominance represents one of the largest technological buildouts in history. Content delivery networks now span continents, with platforms like Netflix operating their own global CDN systems to ensure consistent quality regardless of geography.

AI and machine learning have become central to the streaming experience, powering everything from content recommendations to dynamic thumbnail generation to predictive content caching. These systems process billions of data points daily to optimize everything from encoding quality to ad placement timing.

The rise of edge computing is particularly significant for live streaming and interactive content. By processing data closer to end users, platforms can reduce latency to near real-time levels, enabling new forms of audience participation and engagement that were impossible with traditional broadcasting.

The Cultural Implications

Beyond the business metrics, streaming’s dominance represents a fundamental shift in how culture is created and consumed. The democratization of content creation through platforms like YouTube and TikTok has created new pathways to fame and influence that bypass traditional media gatekeepers entirely.

This has led to the rise of parasocial relationships between audiences and creators, new forms of community building around shared viewing experiences, and the emergence of micro-cultures organized around specific content niches. Streaming platforms have become digital town squares where global conversations about entertainment, politics, and culture unfold in real time.

The binge-watching phenomenon has also altered storytelling structures, with creators developing narratives designed for marathon consumption rather than weekly appointment viewing. This has influenced everything from script pacing to character development to season arc planning.

The Revolution Continues

We’re not witnessing the end of the streaming wars; we’re seeing their evolution into something far more sophisticated than the original battle for subscribers. The platforms that survive the next phase won’t just deliver content; they’ll create experiences so seamless that the line between entertainment and engagement disappears entirely.

The buffer wheel that once symbolized streaming’s limitations has been replaced by AI that anticipates what we want before we know we want it. Predictive algorithms now pre-load content based on viewing patterns, adjust quality in real-time based on network conditions, and even modify content recommendations based on time of day and emotional state indicators.

The next frontier involves even deeper integration between streaming and daily life. Smart home integration allows content to follow users from device to device, while augmented reality overlays promise to transform any screen into an immersive entertainment portal. Voice control and gesture recognition are making content discovery as natural as conversation.

Looking Ahead: The Post-Streaming World

As streaming achieves dominance, the industry is already evolving toward what might be called “ambient entertainment,” content experiences that adapt to context, mood, and environment rather than requiring dedicated viewing sessions. This could include everything from dynamic background entertainment that adjusts to work patterns to immersive experiences that blend physical and digital environments.

The convergence of streaming with gaming, social media, and e-commerce suggests that the ultimate destination isn’t just streaming video, but comprehensive digital lifestyle platforms that integrate entertainment, communication, commerce, and social interaction into seamless experiences.

Virtual and augmented reality technologies promise to add new dimensions to content consumption, while artificial intelligence continues to blur the lines between created and generated content. The next decade may see the emergence of truly personalized entertainment, where every viewing experience is unique to the individual consumer.

What do you think this shift means for your industry? How are you adapting your content and advertising strategies for a streaming-first world? And what comes after streaming dominance? What’s the next revolution in how we consume and create media?

📘 Want to Go Deeper?

If this story resonates, there’s more in my book Streaming Wars: From Broadcast.com to the Future of Digital Media. It’s part insider history, part business strategy, and all about the battles still shaping the future of media.

Amazon: https://amzn.to/43m14oE

Apple Books: https://books.apple.com/us/book/streaming-wars-from-broadcast-com-to-the-future/id6746369305

#TVTrends, #MediaConsumption, #TVViewership, #BroadcastVsStreaming, #TVIndustry, #TVTrends2025, #StreamingGrowth, #CordCutting, #MediaEvolution, #TVHistory, #CableTV, #SatelliteTV, #BroadcastTV, #StreamingServices, #OTTPlatforms, #MediaAnalytics, #TVData, #ConsumerTrends, #DigitalShift, #TVStats

Sources & Useful References:

- Nielsen, “Streaming Reaches Historic TV Milestone, Eclipses Combined Broadcast and Cable Viewing for First Time,” May 2025 https://www.nielsen.com/news-center/2025/streaming-reaches-historic-tv-milestone-eclipses-combined-broadcast-and-cable-viewing-for-first-time/

- The Verge, “Netflix rolls out AI-enhanced ad breaks at 2025 upfront,” 2025 https://www.theverge.com/news/667775/netflix-ai-ad-breaks-upfront-2025

- Source: Pew Research Center: Cable and satellite TV use has dropped dramatically in the U.S. since 2015 https://www.pewresearch.org/short-reads/2021/03/17/cable-and-satellite-tv-use-has-dropped-dramatically-in-the-u-s-since-2015/

- Consumer Reports – Guide to Streaming Video Service https://www.consumerreports.org/electronics-computers/streaming-media/guide-to-streaming-video-services-a4517732799/ This guide discusses the growing dominance of streaming services and the variety of platforms available as of 2024–2025.

- Wikipedia – Cable Television in the United States https://en.wikipedia.org/wiki/Cable_television_in_the_United_States This article provides historical and recent data on cable and satellite TV usage in the U.S., including peak subscription years and the gradual decline through the 2010s and early 2020s.

- Berkeley Economic Review: https://econreview.studentorg.berkeley.edu/the-economics-driving-the-streaming-industry/ The Economics Driving the Streaming Industry. This article explores the economic factors behind the growth of streaming services, comparing costs and consumer preferences between streaming and traditional cable TV.

Recent Comments