Why Live Sports Rights Are Skyrocketing and Why They’re AI-Proof

By Patrick Seaman | CEO @ SportsBug™, Author of Streaming Wars

The streaming wars have fundamentally shifted from a battle over technology to a battle over control. As I explored in my book “Streaming Wars,” this evolution reflects a deeper truth:

“If you don’t control your content, you don’t control your future.”

Today, we’re witnessing a dramatic acceleration in this principle, particularly in live sports rights, where artificial intelligence is creating an unexpected feedback loop that’s driving values to unprecedented heights. But to understand why sports rights are exploding in value, we need to examine the economic forces reshaping the entire content landscape.

The Perfect Storm: Why Sports Rights Are Skyrocketing

1. The Scarcity Economics of Live Moments

Unlike scripted content, which can be produced infinitely, live sports operate on absolute scarcity. There’s only one Super Bowl per year, one World Cup every four years, one March Madness tournament annually. This scarcity creates a fundamentally different economic dynamic than other content categories.

When Netflix can commission a thousand new shows, but there are only 32 NFL teams playing 17 games each, the basic laws of supply and demand kick in with brutal efficiency. Every platform wants exclusive access to these unrepeatable moments, but the supply remains fixed while demand multiplies.

2. The AI Displacement Effect

Morgan Stanley predicts roughly 10 percent savings in scripted content production through AI. But here’s the crucial insight: those savings don’t just disappear. They get reinvested into the content that AI cannot replicate.

When you can produce a drama series for 10% less, streaming platforms suddenly have millions of additional dollars in their content budgets. Since AI can’t generate the genuine emotion of a last-second touchdown or the authentic drama of a playoff series, sports become the obvious destination for that freed-up capital.

This creates a powerful economic cycle: the more efficient AI makes scripted content, the more valuable live sports become.

3. The Subscription Retention Imperative

In an era of rising subscription fatigue, live sports have become the ultimate retention tool. While viewers might cancel their streaming service between seasons of their favorite show, they rarely cancel during football season or the NBA playoffs.

Sports represent what economists call “sticky content.” According to industry data, households with sports streaming subscriptions show 40% lower churn rates than those without. For platforms hemorrhaging subscribers to competitors, sports rights aren’t just content investments. They are insurance policies against cancellation.

4. Global Audience Monetization

Traditional broadcast television was limited by geographic boundaries and time zones. Streaming platforms can monetize sports rights across global audiences simultaneously. A single NFL game can now generate revenue from subscribers in Europe, Asia, and Latin America: markets that traditional broadcasters could barely reach.

This expanded monetization potential means platforms can justify paying significantly more for rights, knowing they can recoup costs across a much larger subscriber base than traditional TV ever could.

5. The Last Bastion of Appointment Television

In our on-demand world, live sports remain one of the few content categories that still command real-time viewing. This “appointment television” quality makes sports incredibly valuable to advertisers and sponsors, who know their messages will be seen live, not skipped or fast-forwarded.

As everything else shifts to time-shifted consumption, the premium for live, simultaneous viewership has skyrocketed.

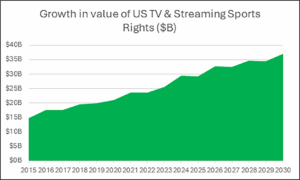

The Numbers Tell the Story

These economic forces are driving dramatic financial results. U.S. TV and streaming sports media rights payments will total $29.25 billion in 2025, over half the global total. This has risen from an estimated $14.64 billion in 2015 and is expected to grow to over $37 billion by 2030.

The acceleration is remarkable:

- S. sports rights could surge from $21 billion in 2022 to $26 billion by 2026, on track to double since 2015

- Globally, sports media rights have grown from $51 billion in 2019 to nearly $56 billion in 2023, with a compound annual growth rate of 12.7 percent

- Morgan Stanley estimates that sports rights deals have increased by about 10 percent per year since the pandemic

The Blockbuster Deals Proving the Point

Recent mega-deals illustrate how these economic forces translate into actual contracts:

- The NHL extended its Canadian media rights deal with Rogers to 2037-38 for $7.7 billion, more than doubling the previous contract

- The NBA’s U.S. deal for the 2025-36 seasons is valued at $6.9 billion per year, roughly double what the previous contract covered

- In India, the IPL’s media rights (2023-2027) are now valued at approximately $6.4 billion, making it the second most valuable sports media property globally

Each deal reflects platforms recognizing that sports aren’t just content. They are competitive moats in an increasingly crowded streaming landscape.

Why Sports Are Generative AI-Resistant

As I noted in “Streaming Wars,”

“The battle for streaming isn’t just about tech. It’s about who controls the stories we watch.”

But live sports represent something uniquely valuable in the AI era: content that cannot be generated, predicted, or replicated.

Unlike scripted entertainment, sports offer:

- Unscripted drama: No algorithm can generate the genuine emotion of a last-second victory

- Real-time engagement: Fans participate in the moment, creating social media buzz that can’t be manufactured

- Cultural relevance: Sports create shared experiences that bind communities and drive water-cooler conversations

Live sports produce high-value, real-time content that AI cannot easily simulate or replace. This makes them especially valuable in a streaming landscape increasingly impacted by AI-driven efficiencies in scripted content costs.

The Streaming Wars 2.0: From Access to Experience

When we built Broadcast.com in the 1990s, we proved a fundamental principle that remains true today: “The shift from linear programming to consumer-controlled access started with early pioneers like Broadcast.com, proving that once people had the choice, they would never go back.”

But today’s battle has evolved beyond just access. By 2025, the number of US viewers who stream a sports event at least once a month is projected to rise to over 90 million, a steep rise from 57 million in 2021. Streaming platforms aren’t just competing for eyeballs. They’re competing for the content that defines cultural moments and prevents subscriber churn.

As Net Insight’s Jonathan Smith observes:

“I think streaming services have been absolutely the catalyst for the rise because they’re hyperscale platforms and, in all cases, they represent some of the largest broadcast platforms in the world.”

The Economic Feedback Loop

We’re witnessing the emergence of a powerful economic cycle that’s self-reinforcing:

- AI reduces scripted content costs by approximately 10%, freeing up capital

- Platforms reinvest savings into scarce sports rights to differentiate and retain subscribers

- Increased bidding competition drives sports rights prices higher

- Higher prices validate sports as premium content, attracting more platform investment

- Success metrics prove sports’ value, justifying even higher future bids

This creates a virtuous cycle for sports rights holders and an increasingly expensive reality for streaming platforms. The more efficient AI makes other content production, the more valuable live sports become, and the more platforms are willing to pay for them.

Looking Ahead: The New Content Hierarchy

As I concluded in “Streaming Wars”:

“The next phase of global streaming won’t just be about expanding access. It will be about who controls the platforms, who owns the content, and who decides what the world gets to watch.”

In the AI era, that control increasingly centers on live sports. The platforms that secure these rights don’t just gain content. They gain the last bastion of truly irreplaceable programming that can’t be optimized, automated, or artificially generated.

The economics are clear: in a world where AI can write scripts and generate scenes, the value of genuine human competition has never been higher. Sports rights aren’t just expensive because they’re popular. They’re expensive because they represent the scarcest commodity in the content universe: authentic, unrepeatable, must-see-live human drama.

For investors, content creators, and industry observers, we’re witnessing the birth of a new content hierarchy where live sports sit at the apex, commanding premium prices precisely because they offer what nothing else can: genuine moments that can’t be replicated, predicted, or replaced.

What do you think? Are we witnessing the transformation of sports into the ultimate premium content category?

#StreamingWars #SportsRights #ArtificialIntelligence #MediaBusiness #StreamingMedia #ContentStrategy #LiveSports #AIinMedia #SportsStreaming #MediaInvestment

Patrick Seaman is the author of “Streaming Wars” (https://amzn.to/43m14oE) and CEO of SportsBug. He was the first employee at AudioNet/Broadcast.com, which pioneered internet broadcasting and was acquired by Yahoo! for $5.7 billion in 1999.

References

AI Impact on Content Production and Sports Rights Investment

Business Insider analysis of how AI is reducing scripted content production costs by 10% and driving increased investment in sports rights as AI-resistant content.

https://www.businessinsider.com/ai-amazon-prime-video-content-spending-netflix-youtube-morgan-stanley-2025-7

U.S. Sports Rights Market Growth to 2030

S&P Global Market Intelligence research showing U.S. sports media rights payments rising from $14.64 billion in 2015 to projected $37 billion by 2030.

https://www.spglobal.com/market-intelligence/en/news-insights/research/sports-rights-in-the-us-to-reach-37-billion-by-2030

U.S. Sports Rights Cost Surge Analysis

WARC forecast indicating U.S. sports rights costs could surge from $21 billion in 2022 to $26 billion by 2026, potentially doubling since 2015.

https://www.warc.com/content/feed/cost-of-us-sports-rights-rockets/en-GB/6987

Current U.S. Sports Rights Market Valuation

PwC analysis placing live sports media rights spend in the U.S. at approximately $28 billion in 2024, with projections for continued growth.

https://www.pwc.com/us/en/industries/tmt/library/sports-streaming-platforms.html

Global Sports Industry Revenue Statistics

PlayToday comprehensive analysis showing global sports media rights growth from $51 billion in 2019 to $56 billion in 2023, with 12.7% CAGR.

https://playtoday.co/blog/stats/sports-industry-revenue-statistics/

NHL Canadian Media Rights Extension

Associated Press coverage of the NHL’s extended Canadian media rights deal with Rogers valued at $7.7 billion through 2037-38, more than doubling the previous contract.

https://apnews.com/article/nhl-tv-canada-rogers-eeb5c822ca0d9069eaa1d80354364e37

NBA Media Rights Deal Analysis

Forbes analysis of the NBA’s U.S. media deal for 2025-36 seasons valued at $6.9 billion per year, roughly double the previous contract value.

https://www.forbes.com/sites/djsiddiqi/2024/08/20/kenny-smith-on-the-future-of-inside-the-nba-and-how-they-can-strike-a-monumental-deal/

Sports Broadcast Rights Market Impact

Inside Sport analysis of major sports broadcast rights deals including Premier League and NBA valuations, with industry expert commentary on streaming’s role.

https://insidersport.com/2025/06/05/net-insight-sports-broadcast-rights/

Indian Premier League Media Rights Valuation

Wikipedia comprehensive overview of IPL television and media rights deals, showing the league’s position as the second most valuable sports media property globally.

https://en.wikipedia.org/wiki/Indian_Premier_League_on_television

Streaming Wars: From Broadcast.com to Today’s Global Audiences

Patrick Seaman’s comprehensive chronicle of the streaming industry’s evolution from the pioneering days of AudioNet/Broadcast.com in the 1990s to today’s global streaming ecosystem, exploring how technology, business models, and audience behavior have transformed media consumption.

https://amzn.to/43m14oE

Recent Comments